Increasing taxes as a means of combating the crisis:Will Russians be forced to pay more, for what exactly, and who might suffer from it? We decided to look into the rumors about the introduction of a "luxury tax" and take a closer look at foreign experience. "Luxury tax" is a favorite idea of left-wing politicians throughout Europe and beyond. At first glance, it really does sound tempting: you need to share with your unlucky compatriots, if you are rich, you have to pay. On the other hand, if you think about it, even with the flat tax scale that currently exists in Russia, the 13 percent that Ivan Ivanovich from a residential area pays, and the 13 percent his namesake from an elite village pays are completely different amounts. Only with a flat tax scale, money usually comes to the budget on time and accurately, and with a progressive scale (the more you earn, the more you give), various options are possible: from "envelopes" to emigration. Russia's 'Luxury Tax' Plans to Impose"luxury tax" of wealthy Russians has been in the air since the early 2000s. The communists were the first to include such a point in the program, followed by all socially oriented parties and movements. But the most active was "A Just Russia". It was their "presentation" that the president took advantage of, suggesting to the Duma in 2011 to think seriously about the problem.

Russia's 'Luxury Tax' Plans to Impose"luxury tax" of wealthy Russians has been in the air since the early 2000s. The communists were the first to include such a point in the program, followed by all socially oriented parties and movements. But the most active was "A Just Russia". It was their "presentation" that the president took advantage of, suggesting to the Duma in 2011 to think seriously about the problem.

Our opinion:— Even then, in the “fat years,” during the discussion of this topic, it was clear that the tax was not being introduced for the purpose of collecting it — the measure was obviously educational: to limit overconsumption, to call wealthy citizens to social responsibility and to stimulate them to buy new machines and workshops with their extra money, rather than another million-dollar watch. Even the tax officials had no illusions: it would not be possible to collect significant money this way.

Our opinion:— Even then, in the “fat years,” during the discussion of this topic, it was clear that the tax was not being introduced for the purpose of collecting it — the measure was obviously educational: to limit overconsumption, to call wealthy citizens to social responsibility and to stimulate them to buy new machines and workshops with their extra money, rather than another million-dollar watch. Even the tax officials had no illusions: it would not be possible to collect significant money this way.

The only oligarch who respondedThen Mikhail Prokhorov responded to this socio-political call. It is understandable: the businessman at that moment was carried away by party building and simply could not help but react.

The only oligarch who respondedThen Mikhail Prokhorov responded to this socio-political call. It is understandable: the businessman at that moment was carried away by party building and simply could not help but react. I am in favor of taxingexcessive consumption. I fall under this as an individual, but I think it is normal. However, I think that such a tax will be very difficult to administer. Mikhail Prokhorov When the passions subsided, the developers of the bills faced a reasonable question: how to assess it. And, finally, how to make people pay this tax, who have the best lawyers and the most advantageous jurisdictions in the world at their disposal? Experts are convinced that the introduction of a "luxury tax" in Russia will first of all lead to the emergence of new ways to evade its payment and the flight of capital abroad.

I am in favor of taxingexcessive consumption. I fall under this as an individual, but I think it is normal. However, I think that such a tax will be very difficult to administer. Mikhail Prokhorov When the passions subsided, the developers of the bills faced a reasonable question: how to assess it. And, finally, how to make people pay this tax, who have the best lawyers and the most advantageous jurisdictions in the world at their disposal? Experts are convinced that the introduction of a "luxury tax" in Russia will first of all lead to the emergence of new ways to evade its payment and the flight of capital abroad. Dmitry Tilevich, Idc collection:— The “luxury tax” itself is a normal story, quite common in the world. The question is what is considered luxury, how exactly to tax it and how to collect this tax. Here we are going our own way, and the most painful will be, first of all, small and medium businesses, as well as top managers. The tax will not affect really rich people much. The tax does not directly apply to the interior theme, which we work on at Eichholtz. And that is already good. idcollection.ru The final version of the “luxury tax” in Russia was limited to two aspects: expensive cars and real estate.

Dmitry Tilevich, Idc collection:— The “luxury tax” itself is a normal story, quite common in the world. The question is what is considered luxury, how exactly to tax it and how to collect this tax. Here we are going our own way, and the most painful will be, first of all, small and medium businesses, as well as top managers. The tax will not affect really rich people much. The tax does not directly apply to the interior theme, which we work on at Eichholtz. And that is already good. idcollection.ru The final version of the “luxury tax” in Russia was limited to two aspects: expensive cars and real estate.

The price of extra meters Strictly speaking,Property taxes have long required revision. It is the property tax that should theoretically ensure uninterrupted replenishment of regional budgets, since it does not depend on the economic situation. And the tax amount itself has until now been levied on the inventory value. It has very little to do with the market value. It turned out that the owner of an expensive apartment in a Stalin-era building in the city center can pay several times less than the owner

The price of extra meters Strictly speaking,Property taxes have long required revision. It is the property tax that should theoretically ensure uninterrupted replenishment of regional budgets, since it does not depend on the economic situation. And the tax amount itself has until now been levied on the inventory value. It has very little to do with the market value. It turned out that the owner of an expensive apartment in a Stalin-era building in the city center can pay several times less than the owner

Our opinion:— We will start paying the new tax in 2016 for the 2015 tax period. During the first 5 years, regional authorities should theoretically provide us with an “adaptation period” — and not allow a sharp increase in our expenses. There are other tools that should reconcile us with reality. First of all, these are tax deductions from objects that are owned: 10 square meters from a room, 20 from an apartment and 50 from a house. Beneficiaries are offered to choose one object, from a garage to a house, which will be excluded from taxation. In this form, the owners of good apartments in old housing stock will suffer from the tax — it is obvious that for them the payment will skyrocket several times, depending on the cadastral value of their property.

Our opinion:— We will start paying the new tax in 2016 for the 2015 tax period. During the first 5 years, regional authorities should theoretically provide us with an “adaptation period” — and not allow a sharp increase in our expenses. There are other tools that should reconcile us with reality. First of all, these are tax deductions from objects that are owned: 10 square meters from a room, 20 from an apartment and 50 from a house. Beneficiaries are offered to choose one object, from a garage to a house, which will be excluded from taxation. In this form, the owners of good apartments in old housing stock will suffer from the tax — it is obvious that for them the payment will skyrocket several times, depending on the cadastral value of their property.

With careful collection, according to calculationsspecialists, this tax will increase the income of Moscow and St. Petersburg by 3-5 times. Accordingly, prestigious areas for individual construction will gradually go to wealthy owners, and the middle class will move to residential areas.

With careful collection, according to calculationsspecialists, this tax will increase the income of Moscow and St. Petersburg by 3-5 times. Accordingly, prestigious areas for individual construction will gradually go to wealthy owners, and the middle class will move to residential areas.

Foreign experience Attempts to introduce a “tax onluxury" for several centuries, even millennia. The first attempt to practice something similar was made in Ancient Greece. But not legislatively. "Liturgy" - that was the name of a large voluntary donation by a wealthy citizen for public purposes - ensured such a high status that the Forbes list could not even dream of. The richest Greeks competed among themselves for the right to include it.

Foreign experience Attempts to introduce a “tax onluxury" for several centuries, even millennia. The first attempt to practice something similar was made in Ancient Greece. But not legislatively. "Liturgy" - that was the name of a large voluntary donation by a wealthy citizen for public purposes - ensured such a high status that the Forbes list could not even dream of. The richest Greeks competed among themselves for the right to include it.

As for more “fresh” stories,They are, with rare exceptions, unsuccessful and most often end in abolition. The most obvious case is the completely populist introduction of such a tax in France. Socialist President François Hollande promised to "squeeze" the rich during the 2012 election campaign. Despite the negative reaction of the majority of the French, he kept his word and, having registered in the Elysee Palace, immediately suggested that everyone whose income exceeds one million euros a year pay about 75 percent to the treasury. The result: thousands of wealthy French people moved from France to Switzerland, Belgium, Britain, the USA and even Russia (remember Depardieu!) along with their taxes. Even the symbol of the French economy, Bernard Arnault, the owner of Louis Vuitton, Givenchy and other luxury brands, began to pack his bags. But Arnault still stayed, but whether his party friends will return is still unclear. What is clear is that the French budget revenues from this action did not increase by a single centime.

As for more “fresh” stories,They are, with rare exceptions, unsuccessful and most often end in abolition. The most obvious case is the completely populist introduction of such a tax in France. Socialist President François Hollande promised to "squeeze" the rich during the 2012 election campaign. Despite the negative reaction of the majority of the French, he kept his word and, having registered in the Elysee Palace, immediately suggested that everyone whose income exceeds one million euros a year pay about 75 percent to the treasury. The result: thousands of wealthy French people moved from France to Switzerland, Belgium, Britain, the USA and even Russia (remember Depardieu!) along with their taxes. Even the symbol of the French economy, Bernard Arnault, the owner of Louis Vuitton, Givenchy and other luxury brands, began to pack his bags. But Arnault still stayed, but whether his party friends will return is still unclear. What is clear is that the French budget revenues from this action did not increase by a single centime.

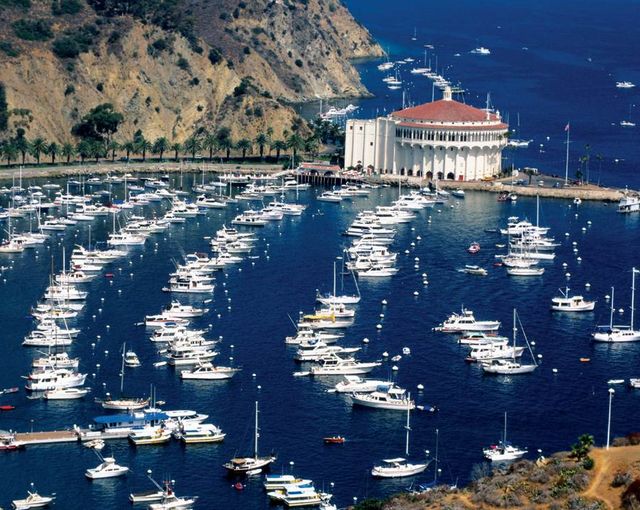

In the US, the "luxury tax" lasted onlythree years. Pragmatic Americans very soon realized that it was easy to re-register a luxury yacht in a neighboring country, but it would take much longer and be much more difficult to reorient an entire shipbuilding industry that was engaged in their production.

In the US, the "luxury tax" lasted onlythree years. Pragmatic Americans very soon realized that it was easy to re-register a luxury yacht in a neighboring country, but it would take much longer and be much more difficult to reorient an entire shipbuilding industry that was engaged in their production.

In many countries, luxury tax replacesprogressive tax scale after a certain level: 800 thousand euros in France, 94 thousand in Norway, 46 thousand in India. In its pure form, such a tax exists in Mexico, Australia and Hungary.

In many countries, luxury tax replacesprogressive tax scale after a certain level: 800 thousand euros in France, 94 thousand in Norway, 46 thousand in India. In its pure form, such a tax exists in Mexico, Australia and Hungary. Our opinion:— China is considered a rare example of significant “luxury taxes.” They earn billions of dollars on imports. According to 2011 data, China accounted for up to 27% of the global luxury goods market turnover. But there is talk of abolishing the tax there, too. The Chinese have begun to seek to buy luxury goods in Europe and other Asian countries, which leads to an uncontrolled outflow of capital, albeit in small amounts. As a result, by 2014, the Chinese began to spend up to 80 percent of their excess income abroad — four times more than at home. And the government is already developing a bill to reduce duties and rates in order to encourage compatriots to spend money at home and increase domestic consumption — a huge stimulus for the Chinese economy.

Our opinion:— China is considered a rare example of significant “luxury taxes.” They earn billions of dollars on imports. According to 2011 data, China accounted for up to 27% of the global luxury goods market turnover. But there is talk of abolishing the tax there, too. The Chinese have begun to seek to buy luxury goods in Europe and other Asian countries, which leads to an uncontrolled outflow of capital, albeit in small amounts. As a result, by 2014, the Chinese began to spend up to 80 percent of their excess income abroad — four times more than at home. And the government is already developing a bill to reduce duties and rates in order to encourage compatriots to spend money at home and increase domestic consumption — a huge stimulus for the Chinese economy. There is, however, a “third way”:Monaco and Switzerland, for example. Small countries in the heart of Europe earn billions on exactly the opposite - that is, on the absence of taxes on luxury, low income taxes and loyalty to wealthy residents. Despite the fact that real estate in Monaco costs tens of times more than on the same coast, but 100 kilometers away, the panorama of "point" development speaks for itself - the real estate crisis has obviously not affected this country.

There is, however, a “third way”:Monaco and Switzerland, for example. Small countries in the heart of Europe earn billions on exactly the opposite - that is, on the absence of taxes on luxury, low income taxes and loyalty to wealthy residents. Despite the fact that real estate in Monaco costs tens of times more than on the same coast, but 100 kilometers away, the panorama of "point" development speaks for itself - the real estate crisis has obviously not affected this country.

Who should pay for luxury: we discuss the new law on the tax on the good life – etk-fashion.com