Tax increases as a means of combating the crisis: will Russians be forced to pay more, for what exactly and who can suffer from this? We decided to understand the rumors about the introduction of the "luxury tax" and look at the foreign experience "Tax on luxury" - the favorite idea of left-wing politicians throughout Europe and not only. At first glance, it really sounds tempting: you need to share with unfortunate compatriots, if you're rich, pay. On the other hand, if you think about it, and with the flat scale of taxation now existing in Russia, 13 percent that Ivan Ivanych pays from the sleeping area, and 13 percent of his namesake from the elite settlement are completely different amounts. Only with a flat scale money comes to the budget, as a rule, on time and accurately, and with the progressive (the more you earn, the more you give), different options are possible: from "envelopes" to emigration.  Russian "luxury tax" Plans to imposeThe "luxury tax" of wealthy Russians has been in the air since the early 2000s. The communists were the first to introduce such an item into the program, followed by all socially oriented parties and movements. But Fair Russia turned out to be the most active. It was her "presentation" that the president took advantage of, inviting the Duma in 2011 to think seriously about the problem.

Russian "luxury tax" Plans to imposeThe "luxury tax" of wealthy Russians has been in the air since the early 2000s. The communists were the first to introduce such an item into the program, followed by all socially oriented parties and movements. But Fair Russia turned out to be the most active. It was her "presentation" that the president took advantage of, inviting the Duma in 2011 to think seriously about the problem.

Our opinion: - Back in the "fat years", during the discussion of this topic it was clear that the tax is not introduced at all in order to collect it - the measure was obviously educational: to limit over-consumption, to call up wealthy citizens for social responsibility and to encourage them to buy for extra money is not the regular clock for a million, but new machines and shops. Even the tax authorities did not have illusions: it would not be possible to collect substantial money in this way.

Our opinion: - Back in the "fat years", during the discussion of this topic it was clear that the tax is not introduced at all in order to collect it - the measure was obviously educational: to limit over-consumption, to call up wealthy citizens for social responsibility and to encourage them to buy for extra money is not the regular clock for a million, but new machines and shops. Even the tax authorities did not have illusions: it would not be possible to collect substantial money in this way.

The only one of the oligarchs who responded thento this social and political appeal, became Mikhail Prokhorov. It is understandable: the businessman at that moment was carried away by party building and could not react simply could not.

The only one of the oligarchs who responded thento this social and political appeal, became Mikhail Prokhorov. It is understandable: the businessman at that moment was carried away by party building and could not react simply could not.  I am an advocate of over-taxingconsumption. I fall under this as an individual, but I think it's okay. However, I think that such a tax will be very difficult to administer. Mikhail Prokhorov When the passions subsided, the developers of the draft laws faced a reasonable question: how to evaluate it. And, finally, how to make people pay this tax, who have the best lawyers and the most profitable jurisdictions in the world at their disposal? Experts are convinced that the introduction of a "luxury tax" in Russia, first of all, will lead to the emergence of new ways of evading its payment and leaving capital abroad.

I am an advocate of over-taxingconsumption. I fall under this as an individual, but I think it's okay. However, I think that such a tax will be very difficult to administer. Mikhail Prokhorov When the passions subsided, the developers of the draft laws faced a reasonable question: how to evaluate it. And, finally, how to make people pay this tax, who have the best lawyers and the most profitable jurisdictions in the world at their disposal? Experts are convinced that the introduction of a "luxury tax" in Russia, first of all, will lead to the emergence of new ways of evading its payment and leaving capital abroad.  Dmitry Tilevich, Idc collection:- The "luxury tax" itself is a normal story, quite widespread in the world. The question is what is considered a luxury, how exactly it is taxed and how this tax is then collected. Here we go our own way, and it will be most painful, first of all, for small and medium-sized businesses, as well as for top managers. The really rich people will not be greatly affected by the tax. The interior theme, which we deal with at Eichholtz, is not directly taxed yet. And this is already good. idcollection.ru The final version of the "luxury tax" in Russia was limited to two aspects: expensive cars and real estate.

Dmitry Tilevich, Idc collection:- The "luxury tax" itself is a normal story, quite widespread in the world. The question is what is considered a luxury, how exactly it is taxed and how this tax is then collected. Here we go our own way, and it will be most painful, first of all, for small and medium-sized businesses, as well as for top managers. The really rich people will not be greatly affected by the tax. The interior theme, which we deal with at Eichholtz, is not directly taxed yet. And this is already good. idcollection.ru The final version of the "luxury tax" in Russia was limited to two aspects: expensive cars and real estate.

The price of extra meters Strictly speaking, propertytaxes have long demanded revision. It is the property tax that theoretically should ensure uninterrupted replenishment of regional budgets, since it does not depend on the economic situation. And the amount of tax itself has so far been levied on the inventory value. It has a very distant relationship to the market one. It turned out that the owner of an expensive apartment in a Stalinist building in the city center could pay several times less than the owner

The price of extra meters Strictly speaking, propertytaxes have long demanded revision. It is the property tax that theoretically should ensure uninterrupted replenishment of regional budgets, since it does not depend on the economic situation. And the amount of tax itself has so far been levied on the inventory value. It has a very distant relationship to the market one. It turned out that the owner of an expensive apartment in a Stalinist building in the city center could pay several times less than the owner

Our opinion: - We will begin to pay a new tax from 2016 for the tax period of 2015. During the first 5 years, the regional authorities should theoretically provide us with an "adaptation period" - and not allow a sharp increase in our spending. There are other tools that must reconcile us with reality. First of all, it is tax deductions from the objects that are in the property: 10 square meters from the room, 20 from the apartment and 50 from the house. Benefits are offered to choose one object, from the garage to the house, which will be excluded from taxation. In this form, the owners of good apartments in the old housing fund will suffer from the tax - it is obvious that for them the payment will soar at times, depending on the cadastral value of their real estate.

Our opinion: - We will begin to pay a new tax from 2016 for the tax period of 2015. During the first 5 years, the regional authorities should theoretically provide us with an "adaptation period" - and not allow a sharp increase in our spending. There are other tools that must reconcile us with reality. First of all, it is tax deductions from the objects that are in the property: 10 square meters from the room, 20 from the apartment and 50 from the house. Benefits are offered to choose one object, from the garage to the house, which will be excluded from taxation. In this form, the owners of good apartments in the old housing fund will suffer from the tax - it is obvious that for them the payment will soar at times, depending on the cadastral value of their real estate.

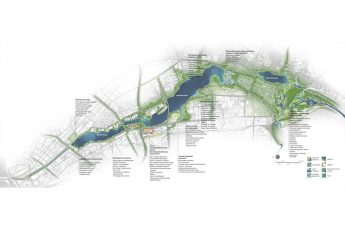

With careful collection, according to calculationsspecialists, this tax will provide an increase in the income items of Moscow and St. Petersburg by 3-5 times. Accordingly, prestigious areas for individual construction will gradually pass to wealthy owners, and the middle class will go to residential areas.

With careful collection, according to calculationsspecialists, this tax will provide an increase in the income items of Moscow and St. Petersburg by 3-5 times. Accordingly, prestigious areas for individual construction will gradually pass to wealthy owners, and the middle class will go to residential areas.

Foreign experience Attempts to introduce a “tax onluxury "for several centuries, even - millennia. For the first time something similar was tried to be practiced back in Ancient Greece. But not legislatively. "Liturgy" - as the large voluntary donation of a wealthy citizen for public purposes was called - provided such a high status that the Forbes list never dreamed of. The richest Greeks competed among themselves for the right to contribute.

Foreign experience Attempts to introduce a “tax onluxury "for several centuries, even - millennia. For the first time something similar was tried to be practiced back in Ancient Greece. But not legislatively. "Liturgy" - as the large voluntary donation of a wealthy citizen for public purposes was called - provided such a high status that the Forbes list never dreamed of. The richest Greeks competed among themselves for the right to contribute.

As for the more "recent" stories, they,with rare exceptions, they are unsuccessful and most often end in abolition. The most obvious case is the completely populist introduction of such a tax in France. Socialist President François Hollande promised to "squeeze" the rich even during the 2012 election campaign. Despite the negative reaction of the majority of the French, he kept his word and, registering at the Elysee Palace, immediately invited everyone whose income exceeds one million euros a year to pay about 75 percent to the treasury. Bottom line: thousands of wealthy Frenchmen moved from France to Switzerland, Belgium, Britain, the United States and even Russia (remember Depardieu!) Along with their taxes. Even the symbol of the French economy, Bernard Arnault, owner of Louis Vuitton, Givenchy and other luxury brands, has begun packing his bags. But Arno still stayed, but it is not yet clear whether his party friends will return. Obviously, another thing is that the revenues of the French budget from this action did not increase by a centime.

As for the more "recent" stories, they,with rare exceptions, they are unsuccessful and most often end in abolition. The most obvious case is the completely populist introduction of such a tax in France. Socialist President François Hollande promised to "squeeze" the rich even during the 2012 election campaign. Despite the negative reaction of the majority of the French, he kept his word and, registering at the Elysee Palace, immediately invited everyone whose income exceeds one million euros a year to pay about 75 percent to the treasury. Bottom line: thousands of wealthy Frenchmen moved from France to Switzerland, Belgium, Britain, the United States and even Russia (remember Depardieu!) Along with their taxes. Even the symbol of the French economy, Bernard Arnault, owner of Louis Vuitton, Givenchy and other luxury brands, has begun packing his bags. But Arno still stayed, but it is not yet clear whether his party friends will return. Obviously, another thing is that the revenues of the French budget from this action did not increase by a centime.

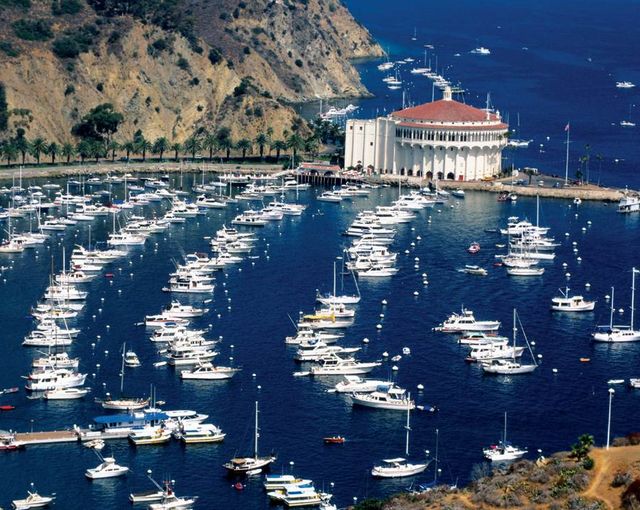

In the United States, the "luxury tax" lasted only threeof the year. Pragmatic Americans soon realized that luxury yacht is easy to reproduce in a neighboring country, but to reorient the whole industry in shipbuilding, which was engaged in their production, is much longer and more difficult.

In the United States, the "luxury tax" lasted only threeof the year. Pragmatic Americans soon realized that luxury yacht is easy to reproduce in a neighboring country, but to reorient the whole industry in shipbuilding, which was engaged in their production, is much longer and more difficult.

In many countries, the luxury tax replacesprogressive scale of taxation after a certain level: 800 thousand euros in France, 94 thousand in Norway, 46 thousand in India. In its pure form, such a tax exists in Mexico, Australia and Hungary.

In many countries, the luxury tax replacesprogressive scale of taxation after a certain level: 800 thousand euros in France, 94 thousand in Norway, 46 thousand in India. In its pure form, such a tax exists in Mexico, Australia and Hungary.  Our opinion: - A rare example of substantial "luxury fees" is China. On import, they earn billions of dollars. According to 2011 data, China accounted for up to 27% of the world's luxury goods turnover. But talk about the cancellation of the tax goes and there. The Chinese began to seek to buy luxury goods in Europe and other countries in Asia, which leads to uncontrolled export of capital, albeit in small things. As a result, by 2014, the Chinese began to spend up to 80 percent of their super profits abroad - four times more than at home. And the government is already drafting a bill to reduce duties and rates to encourage compatriots to spend money at home and increase domestic consumption - a frantic incentive for the Chinese economy.

Our opinion: - A rare example of substantial "luxury fees" is China. On import, they earn billions of dollars. According to 2011 data, China accounted for up to 27% of the world's luxury goods turnover. But talk about the cancellation of the tax goes and there. The Chinese began to seek to buy luxury goods in Europe and other countries in Asia, which leads to uncontrolled export of capital, albeit in small things. As a result, by 2014, the Chinese began to spend up to 80 percent of their super profits abroad - four times more than at home. And the government is already drafting a bill to reduce duties and rates to encourage compatriots to spend money at home and increase domestic consumption - a frantic incentive for the Chinese economy.  There is, however, a "third way": Monaco and Switzerland for example. Smaller countries in the heart of Europe earn billions on the contrary - that is, in the absence of taxes on luxury, low income taxes and loyalty to wealthy residents. Despite the fact that real estate in Monaco is tens of times more expensive than on the same coast, but 100 kilometers to the side, the panorama of "point" building speaks for itself - the crisis of real estate this country obviously did not touch.

There is, however, a "third way": Monaco and Switzerland for example. Smaller countries in the heart of Europe earn billions on the contrary - that is, in the absence of taxes on luxury, low income taxes and loyalty to wealthy residents. Despite the fact that real estate in Monaco is tens of times more expensive than on the same coast, but 100 kilometers to the side, the panorama of "point" building speaks for itself - the crisis of real estate this country obviously did not touch.

To whom to pay for luxury: we are discussing a new law on a tax on a good life - etk-fashion.com